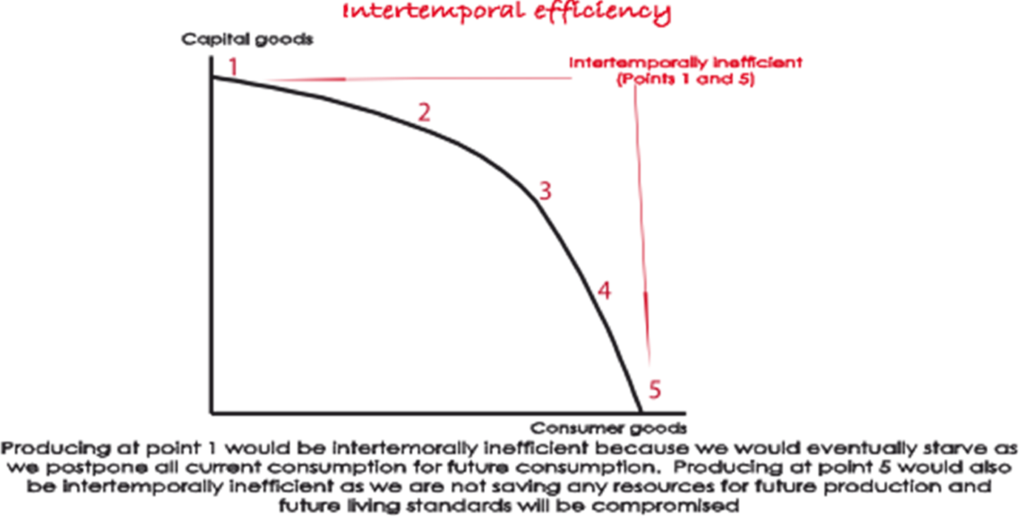

Intertemporal efficiency

Intertemporal efficiency refers to a firm, government or indeed the nation having just the right balance between resources used for current as opposed to future use. For example, with reference to the PPC below, it can be represented by the economy not producing at either extreme when the broad choices are ‘consumer goods’ and ‘capital goods.’ In other words, too much consumption relative to investment in capital (point 5), or too much investment relative to consumption (point 1), will mean that the economy’s use of resources is intertemporally inefficient.

The unsustainable use of a nation’s resources (e.g. depleting fishing stocks or native forests) or emitting excessive volumes of CO2 into the atmosphere are common examples of how intertemporal efficiency might not be achieved. The focus of many government policies is to achieve greater intertemporal efficiency so that we use our resources sustainably and current generations do not impose an unfair burden on future generations. The attempts to price the environment into economic decision making, such as the pricing of carbon by many governments around the world, is an example of policy efforts targeted at improving intertemporal efficiency. See market failures.

Course notes quick navigation

1 Introductory concepts 2 Market mechanism 3 Elasticities 4 Market structures 5 Market failures 6 Macro economic activity/eco growth 7 Inflation 8 Employment & unemployment 9 External Stability 10 Income distribution 11.Factors affecting economy 12 Fiscal/Budgetary policy 13 Monetary Policy 14 Aggregate Supply Policies 15 The Policy Mix